Verification

Learn how to get verified for the safest possible trading.

KYC (KYC) VERIFICATION INSTRUCTIONS

Know Your Customer (KYC) is a regulatory principle that requires financial institutions to verify the identity of their customers before conducting transactions.

KYC helps protect both the company and its customers from fraud and other criminal activities.

Account verification is a set of measures that help brokers ensure their customers are of legal age and have the means to fund their accounts.

Account verification also helps prevent money laundering and other fraudulent activities.

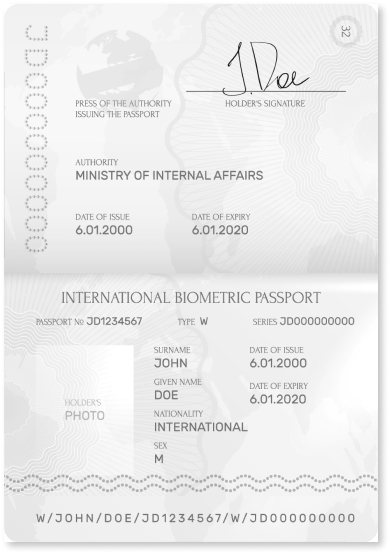

To complete the verification process, customers must submit scanned copies or high-resolution photographs of their identification documents within two days of opening their trading accounts.

Customers who made a deposit with a bank card

To verify your account, you need to submit a valid identity document such as a passport or driving license. Additionally, you need to provide a document that confirms your address, which could be a utility bill or bank statement. EU residents can provide a utility, internet, or mobile phone bill in their name within three months. You also need to provide a photo of the bank card used for the deposit. Finally, you need to fill and sign a declaration form sent by the verification department to your email.

Customers who made a deposit in cryptocurrency

Identity card, proof of identity.

DOCUMENT REQUIREMENTS:

Copy of documents must be in color and fully legible

Spreads of the document with corners and edges must be fully visible, without any cropped edges

The image should not contain any traces of graphic editing, erased elements, notations, crossed-out words, or corrections of any other kind

Documents must be valid at the time of the request and bear all proper seals and signatures.

Additionally, it is important to ensure that all documents are clear and easy to read to prevent any delays in the verification process.